For example lets say your annual taxable income is RM48000. Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

In the past the tax rates of these companies were 0 5 and 10.

. Malaysia Non-Residents Income Tax Tables in 2019. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. The rate of Sales Tax ranges from 5 to 10.

Following the Budget 2020 announcement in October 2019 the reduced rate of 17 is applicable to the first RM600000 chargeable income in hopes that more Malaysians will get into businesses and in turn. Income tax rates. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019.

Either company owns at least 70 of the ordinary share capital of the other company or a third company owns at least 70 of each of the companies and. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. Calculations RM Rate TaxRM A.

Tax Rate of Company. Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the investments and commitments to job-creation. Similarly non-resident companies are also taxed at a rate of 24.

Industrys response to govts 20-bn Malaysia Personal Income Tax Rates Table 2012 - Tax Updates Malaysia Personal Income Tax Rates Table 2010 - Tax Updates. If the paid-up capital is RM 25 million or less for a resident company when the basis period of annual assessment commences the company tax is 18 on the first RM 500000 of income and it rises to 24 on the successive increment of chargeable income. Companies with income exceeding RM 2500000 per year are taxes at 25 Sales Tax Service Rate The two major types of consumption taxes in Malaysia are Sales tax and Service tax.

Income Tax Rates and Thresholds. Other rates are applicable to special classes of income eg. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar.

Tax Rates for Company Company tax applies to all those companies that are registered in Malaysia. 6 rows Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in. 0 to 5 Tax Rates for Incoming Companies.

Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. 20182019 Malaysian Tax Booklet 22 Rates of tax 1. However there are exceptions for certain sectors.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Related company is defined in the Income Tax Act 1967 and involves the application of a two-tier test. Malaysia Personal Income Tax Rate.

On the First 5000. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the. If the first chargeable income of an SME is RM500000 such a company is charged at a rate of 18.

11 rows Malaysia Non-Residents Income Tax Tables in 2019. Income Tax Rates and Thresholds. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Approved companies may apply and enjoy incentives that are available for their business sector. Tax Rates for Individual Assessment Year 2019. On the First 5000 Next 15000.

Here are the progressive income tax rates for Year of Assessment 2021. The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Except for food preparations with non-alcoholic compound preparations.

If you have any further enquires feel free to contact Acclime. Company with paid up capital more than RM25 million. Rate The first RM600000.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Company with paid up capital not more than RM25 million. In case the income exceeds beyond this limit of chargeable income it is charged at a rate of 24 tax.

Revenues Malaysia Personal Income Tax Guide 2020 YA 2019 Big smile and two thumbs up. The companies are regarded as related if. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Company with paid up capital not more than RM25 million company tax rates is 17 on first RM600000. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. KTP Company PLT Audit Tax Accountancy in Johor Bahru.

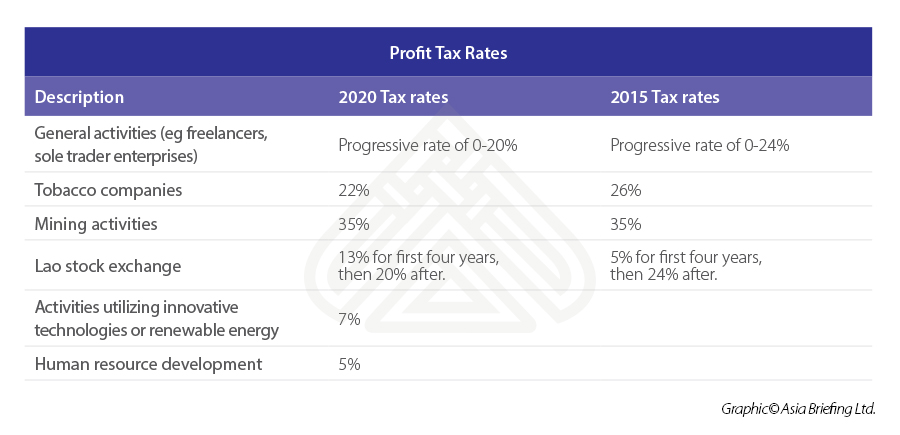

Tax Identification Numbers In Laos Compliance By June 2021

Excel Formula Income Tax Bracket Calculation Exceljet

Send You 1279 Plr Articles On Finance Planning

Corporation Tax Rate Increase In 2023 From 19 To 25

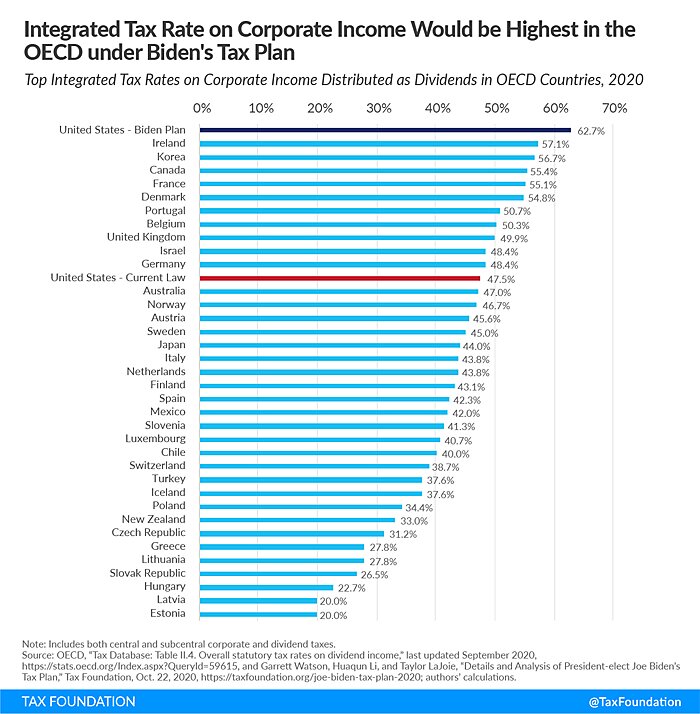

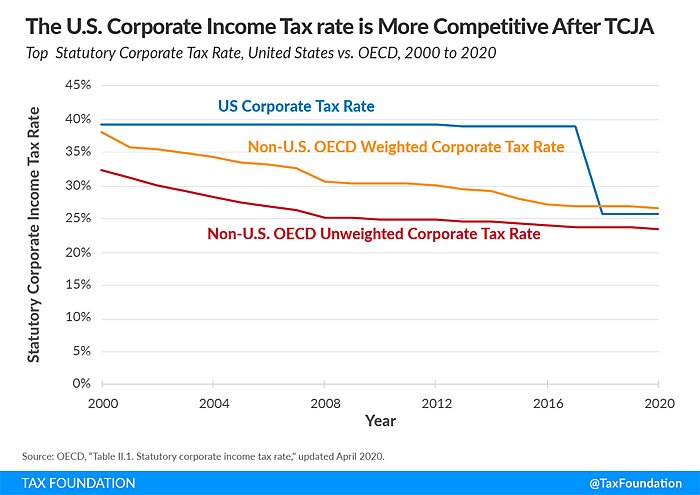

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Maharashtra Introduces 31 Gst Reforms For Ease Of Doing Business Read More Https Bit Ly 2icmxoq Gst Gst Business Read Goods And Services Digital Signature

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Tax Information What Are Taxes How Are They Used

Corporate Income Tax In Malaysia Acclime Malaysia

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

500 Loan No Credit Check Online Today Fast 500 Loan Bad Credit Ok At Unitedfinances Com Loan Interest Rates Personal Loans Home Loans

Anterin The Dark Horse Between Gojek And Grab Dark Horse Startup News The Darkest

Carbon Taxes Worldwide By Select Country 2021 Statista

Corporate Income Tax In Malaysia Acclime Malaysia

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Bitcoin Price Prediction Today Usd Authentic For 2025